Odds are pretty high that at this moment, right now, your pricing is too low. Let me be more clear: Unless you actively know that your pricing’s not too low, your pricing is probably too low.

When you first launch a startup, you don’t really know how much people will value the software you’ve created. So it’s hard to price. You come up with something that feels maybe correct, you launch, and you hope.

And then, and this is the critical place that almost every startup makes a mistake at, you leave it. You say, well, we came up with pricing once a year ago. Why change it now?

When you’re starting, picking a number and a pricing methodology kind of out of the air is fine. Better than having no pricing at all.

But iterating on pricing needs to be a regular practice in your startup. Not only does it help you earn more money for each new customer, it’s an action that explicitly includes and excludes part of your market.

One of the classic 5 “P”s of marketing is “Pricing.” What you charge will select your audience for your company’s Go To Market as clearly as who you say you sell to.

Scrappy startups won’t bother even talking to you if you post a $1k a month price tag as your base plan. Likewise, most enterprise companies won’t bother to pick up the phone to call you if your pricing page has “5 / Month | $20 / month | Call Us” because as much as you may say you’re ready to sell to enterprise customers, a company that doesn’t regularly land six-figure deals aren’t going to be ready to sell to an enterprise company just because their pricing page says so.

It’s easy to ignore pricing at the start

You’ve got enough going on with your new features to launch, content to push out the door for your marketing team, a new VP of Sales to hire, and so on and so on.

But there are 3 classic reasons why your pricing is wrong RIGHT NOW, and they can doom your business:

- Charging a fraction of the competition

- Forgetting to update pricing with new features

- Ignoring new audiences

Fractional pricing

A common first pricing tactic is to look at major players and say, “we’ll charge 20% of those guys.” You don’t have as many features as established players, after all. So that sounds sensible.

But your customers want you, not the competition.

Your happiest customers will almost certainly be willing to pay you more without being any less happy about your product.

Why in the world are you leaving that money on the table, then?

New features added value

When you ship new features, your product is more valuable.

I know, I know. Features don’t sell your product. Results do.

But when you have more ways you can create positive results for your customers, you can reasonably bill them more, too.

Just make sure that the new features you’ve added are ones that drive direct positive results for your happiest customers and then you’re ready for a new set of pricing tests to see what difference that new feature made.

Ignoring new audiences.

You launched with one idea of how your business was going to go to market.

After 6 months, a whole new kind of user has come along and they love what you’re doing.

Different audiences have different capacities to pay for your service. As mentioned above, pricing determines the audience in many ways, but the audience can (and should!) also change pricing.

If you suddenly find that you’re selling a lot in Healthtech or Fintech or Edtech or another sector you didn’t intend to launch into, keep in mind that tickets go up, but so does customer lifecycle, too.

In your first year of go-to-market, at the very minimum, you should be testing pricing once a month. Raise prices once a week / a month / whenever. You want prices high enough where around 20% of your leads are giving you pushback on price before converting.

If you don’t keep testing pricing, you’re stunting your own ability to grow. Building a good framework for testing & measuring it accurately is tough–cohort-level reporting on CAC and LTV is crucial here–but good tools like Matomo Analytics and ProfitWell reporting are a huge help.

Where do you test your pricing?

Pricing determines audience and audience determines pricing.

More subtly, pricing–and when you talk about it–can completely change acquisition costs and who you bring on a buyer journey.

There are 3 main inflection points you can learn from with pricing tests:

- Impression to click

- Visit to sign up

- Trial to paid

1. Testing pricing at the top of the funnel (impression -> click)

The very top of your funnel gives you immediate feedback on how price-sensitive your audience is.

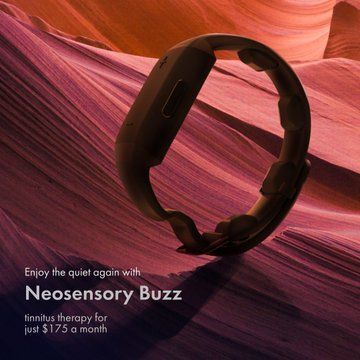

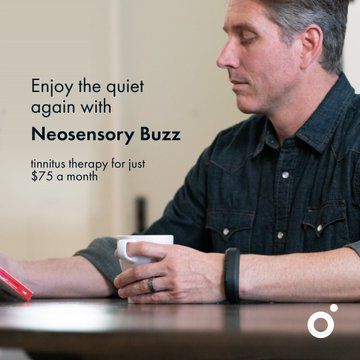

My favorite way to do this is to run ads to your identified target audience and include the price for your product in the ads.

This is dead simple.

You’re gonna make 2 – 5 different ads that each test a different price point, like these.

What you’re looking to learn:

- What price has the strongest effect on visits?

- Do users at different price points take different actions on your website?

- What is the most attractive ratio of price to CPC? Price to CPA?

What this tells you:

- Who is your audience?

- How price-sensitive are they?

- What are your basic unit economics for demand generation?

Don’t do this:

- Test ad designs & pricing at the same time are bad. I know it looks like that’s what I was doing in the example pics above, but I had full ad sets at each different price. 😛

- Test multiple prices to the same audience at the same time! Build exclusion lists to manage your audiences

- Worry about the landing page prices for the first pricing experiment or two. That waits for:

2. Testing your visitor’s actions (Visit -> Signup)

Once you’ve run a pricing test or two and you know what audience responds best at what price, you’re ready to see if pricing affects signups.

For later pricing tests, each ad should direct people to different landing pages where the pricing there reflects you should be directing people to specific pages based on the price you were showing them.

Other than pricing, you want the landing pages to be identical. You’ll need good on-page analytics like Hotjar or Fullstory to track visitor interaction more accurately.

(No, I don’t include Google Analytics as “good on-page analytics” for this use case because almost everyone has their GA4 set up wrong. 😛 )

What you’re looking to learn:

- What do visits do?

- What is your sign-up rate?

- Do different traffic sources sign up at different prices?

- Do different prices sign up at different races?

What this tells you:

- Does your LP deliver on the promise of your ad?

- Have you interested the lead?

Don’t do this:

- Don’t test CTAs / prices that fit poorly together.

- $5 products shouldn’t have “book a call”. $1k products should, but then you don’t want “Sign up Free” as your main CTA.

3. Testing your product’s persuasiveness (Signup -> Sale)

Once you have trials/demos, your last key element of a pricing test is to see how they convert.

When you’re analyzing the click, you’re seeing how price sensitive your audience is. When you’re analyzing the LP visit to signup/demo, you’re developing an understanding of how well you can explain your benefits to different audiences.

Your final conversion rate is where the rubber meets the road. It’s beyond just marketing and it really asks: does your product fulfill the promise your landing page made?

If so, you should see 30%+ conversion rates. If not, well, you’ll have a bad time.

The best way you can improve this final conversion rate is with some kind of user onboarding.

Different price points come with different expectations for onboarding, but your minimum goal should be to deliver value for any new signup in <5 minutes.

Cohort reporting with a tool like ProfitWell is a must.

What you’re looking to learn:

- Does your demo or trial deliver on the promise your landing page made?

- What expectations does each price point come with?

- How will delivering what different price points expect from me change your business?

What this tells you:

- Do your leads find that your product is valuable enough to be worth the cost?

- Does your onboarding make the case that your tool is useful?

Don’t do:

- Bad data will kill your experiments here.

- You need to clearly understand

- what kind of plan a user signed up for

- how long they are signed up

- how quickly they converted and (eventually)

- how long they paid for

- You need to clearly understand

You ideally want to find the best fit for your audience & price as fast as you can when you launch your startup. Every 3 – 12 months (depending on how fast you ship) you’ll need to tackle pricing again. Pricing is fascinating & the core of your startup.

So keep it top of mind. 🙂

Launching a pricing test

This has been a lot of talk about why to test. But how do you do it? What kind of prices do you want to test?

When talking about B2B pricing tests, you want to go big or go home.

“Do small iterative change, you may say.

“Test $5, $10, and $15 a month,” you think. That’s perfect for B2C sales, where people’s pockets tend to be much more sensitive to price changes.

But when you consider how people buy in B2B contexts, you’ll realize that’s all wrong.

For B2B sales, the difference between $5 and $15 isn’t even there. Most B2B sales are spending someone else’s money, after all.

So you need to think about “who will approve the sale?” When you test substantially different prices, you’re basically seeing who in a company’s org chart will approve your SaaS subscription.

This means, when you first test pricing, try something more like $5, $50, and $200 a month.

At $5 a month, many companies will have dedicated team members just pay for a tool with their own personal credit card if it makes their job much easier. It’s kind of an impulse buy at the business level, and if your model is to land and expand it can be a great start.

$50 a month (or $49) is often a price point at which you’ll find team leads have the approval to buy. Another common one will be $82 a month (<$1k a year).

This is good, If you can sell without higher management approval. You will sell much faster, provided you aren’t getting blocked by IT / security at your clients.

Finally, $200 – $400 a month range is frequently the most you’ll find director-level or VP-level are cleared to approve without oversight from a whole buying committee. Prices higher than that will take 3 – 6 months to close and will require a bewildering and complex sales cycle.

Of course, if you have the capacity to support long and complex sales, you can go up from there.

It’s important to learn this lesson in B2B pricing. When you’re testing pricing, you’re not really looking at “what the dollar value someone finds for my product?”

You’re looking for “who is the best person for me to sell to in a team?”

And timid pricing tests won’t tell you that.